XRP Price Prediction: $6 Surge Possible Amid Regulatory Breakthroughs

#XRP

- Technical Outlook: Neutral-bullish with 3.66 resistance and 2.675 support

- Regulatory Catalyst: SEC case resolution expected by August 2025

- Market Psychology: Whales accumulating despite volatility

XRP Price Prediction

XRP Technical Analysis: July 2025 Outlook

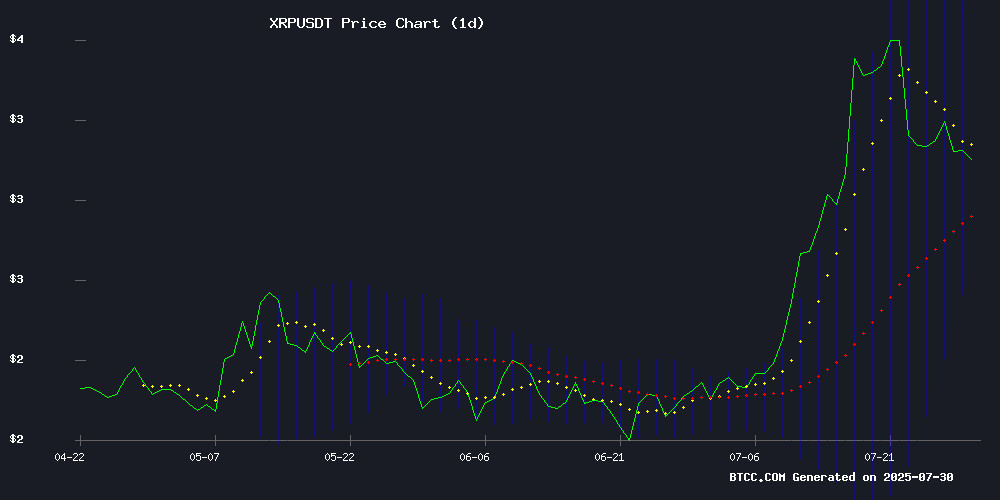

According to BTCC financial analyst Sophia, XRP is currently trading at, slightly below its 20-day moving average of 3.1681, indicating a neutral-to-bearish short-term trend. The MACD histogram shows a slight bullish crossover (+0.1180), but remains in negative territory. Bollinger Bands suggest volatility contraction with price hovering NEAR the middle band.

Key levels to watch:

- Resistance: 3.6611 (Upper Bollinger Band)

- Support: 3.080 (recent Fibonacci level) followed by 2.6750 (Lower Bollinger Band)

XRP Market Sentiment: Regulatory Crossroads

Sophia notes mixed market signals for XRP:

- Bullish Factors: Strong $3 support, potential SEC case resolution in August, and whale accumulation

- Bearish Pressures: $2.4B pullback risk, declining volume, and negative headlines like the $17M theft case

The Fed rate decision could amplify volatility, but technicals suggest the $3 support remains pivotal.

Factors Influencing XRP's Price

Ripple (XRP) Holds $3.00 Support Amid Regulatory Anticipation and Fed Rate Decision

Ripple's XRP defends the $3.00 support level as market volatility spikes ahead of the Federal Reserve's interest rate decision. While rates are expected to remain steady, Chair Jerome Powell's commentary will shape risk sentiment moving forward.

The White House prepares to release a pivotal cryptocurrency policy report, outlining guidelines for stablecoins and broader regulatory frameworks. This marks the Biden administration's first major step toward establishing the U.S. as a global crypto hub.

Derivatives data reveals waning interest in XRP, with futures open interest and trading volume declining sharply. The asset's resilience at $3.00 suggests technical strength despite cooling speculative activity.

Ripple's Legal Battle with SEC Nears Potential Resolution as August Deadline Looms

The protracted legal confrontation between Ripple and the U.S. Securities and Exchange Commission approaches a critical juncture. Judge Analisa Torres' 2023 ruling that secondary market XRP sales don't constitute securities remains contested, with the SEC maintaining its appeal despite Ripple's withdrawn cross-appeal.

Legal observers note the absence of formal deadlines for appeal withdrawal, though the regulator must file a status update by August 15. Market participants interpret this as a potential inflection point—SEC's abandonment of the appeal could finally resolve the litigation originating from December 2020 allegations of unregistered securities offerings.

The case's outcome carries significant implications for cryptocurrency regulation, particularly regarding the classification of digital assets in secondary trading venues. Recent joint motions from both parties suggest settlement discussions may be progressing behind the scenes.

$17M XRP Heist: Widow of Country Music Icon Victim in Alleged Crypto Theft

A Tennessee man was arrested for allegedly stealing millions in XRP tokens from Nancy Jones, widow of country music legend George Jones. The suspect, reportedly a romantic partner, faces charges in a case highlighting the risks of cryptocurrency holdings among high-profile individuals.

The theft underscores persistent security challenges in digital asset management, even as institutional adoption grows. XRP's prominence in this high-value heist may reignite debates about regulatory oversight for cryptocurrencies frequently targeted by bad actors.

XRP Holds Firm Above $3 as Wave 5 Targets $6 Surge

XRP maintains its bullish stance, holding steady above the critical $3 support level. Analysts observe a Wave 4 consolidation phase, with expectations mounting for a Wave 5 rally that could propel prices toward $6.

Dark Defender's technical analysis confirms the completion of Waves 1 through 3, with the current Wave 4 representing a temporary pause in the uptrend. The Relative Strength Index suggests the market is gathering strength for its next move.

Key support rests at $3.07. A successful Wave 4 completion could trigger the anticipated Wave 5 surge, with projected targets at $3.61 initially, followed by a potential push to $5.8563. Market participants watch these developments closely as XRP demonstrates resilience in its current uptrend.

XRP Breaks 2018 Record High Amid Favorable Regulatory Climate

XRP (XRP -1.26%), the cryptocurrency developed by Ripple Labs, has surged to a new all-time high of $3.84, eclipsing its previous peak from 2018. The asset delivered a 235% gain in 2024 and continues its upward trajectory with a 35% rise year-to-date in 2025.

The rally coincides with a regulatory thaw in the U.S. under the TRUMP administration, creating tailwinds for digital assets. XRP's utility in Ripple Payments—a cross-border settlement network that bypasses intermediaries like SWIFT—positions it as a pragmatic solution for institutional payment inefficiencies.

Market observers note historical parallels: the last time XRP achieved record highs, it preceded a period of heightened volatility. The current breakout suggests renewed institutional interest in blockchain-based payment rails.

XRP Traders Face $2.4B Pullback as Market Debates Next Move

XRP's recent 15% correction from its July 18 peak of $3.66 has erased $2.4 billion in open futures positions, leaving traders divided between defensive positioning and opportunistic accumulation NEAR $2.60. The rally that preceded this pullback saw open interest surge to $11.2 billion before retreating 20% to $8.8 billion, with liquidations totaling $325 million over two weeks.

Futures markets show remarkable composure despite the volatility, with annualized premiums holding steady at 6-8%. This stability suggests institutional participants remain cautiously engaged rather than capitulating. Speculation about a potential US spot XRP ETF continues to simmer, drawing parallels to Ether's $18 billion ETF-fueled inflows, though regulatory timelines remain uncertain.

XRP Faces Price and Volume Decline Amid Market Shifts

Ripple's XRP dipped 1.08% to $3.12, with trading volume plunging nearly 18% to $5.76 billion. The simultaneous retreat in both metrics suggests weakening trader interest, potentially foreshadowing a trend reversal despite XRP's 10.33% weekly gain. Market capitalization now stands at $184.95 billion.

Meanwhile, Four and XDC Network emerged as top performers, while Conflux and Celestia led losers. The broader crypto market continues reacting to macroeconomic pressures and project-specific developments.

2 Cryptocurrencies Predicted to Surge Up to 324% by 2028: Wall Street Analyst's Bold Forecast

Geoff Kendrick, a prominent Wall Street analyst, has identified XRP and another leading digital asset as high-growth candidates poised for significant appreciation. The projection hinges on institutional adoption and technological utility in cross-border payments.

XRP, Ripple's bridge currency, receives particularly aggressive targets—$5.50 by 2025, scaling to $12.50 by 2028. Such appreciation would elevate it past ethereum in market capitalization. Kendrick cites regulatory clarity and banking sector integration as key catalysts.

Ripple Whales Continue Accumulating XRP Despite Market Volatility

Ripple whales have intensified their accumulation of XRP, purchasing 60 million tokens worth approximately $180 million in a single day. This follows a broader trend of large-scale acquisitions, including 2.2 billion XRP scooped up earlier in July during a price surge to $3.6.

Market dynamics reveal a calculated strategy: whales capitalized on the recent dip below $3, acquiring an additional 130 million tokens. Such sustained buying pressure reduces circulating supply while signaling confidence to retail investors.

Despite these developments, XRP's price remains disconnected from whale activity. The token's failure to rally suggests complex market forces at play, including lingering regulatory uncertainty and mixed signals from Ripple's leadership.

XRP Finds Support at $3.080 After Fibonacci Retracement Test

XRP's price action diverged from broader market trends as it breached multiple support levels, including $3.250 and $3.220, before testing the 76.4% Fibonacci retracement level near $3.080. The cryptocurrency's recovery gained traction after breaking above a bearish trend line at $3.120, though technical indicators remain mixed.

The correction saw XRP underperform against Bitcoin and Ethereum, dropping below the 50% retracement level of its recent upward move. Bulls emerged near the $3.080 support zone, which aligns with the 76.4% Fibonacci level of the prior rally. Current trading remains below both the $3.20 psychological level and the 100-hour moving average.

Market participants are watching the $3.20 resistance level closely. A decisive breakout could open the path toward $3.250 and potentially test the $3.330 high. The RSI's position above 50 suggests some bullish momentum, though the MACD's bearish divergence warrants caution.

George Jones’ Widow Allegedly Loses $17 Million in XRP to Ex-Boyfriend

Nancy Jones, widow of country music icon George Jones, has reportedly been defrauded of $17 million worth of XRP. The alleged perpetrator, her 58-year-old ex-boyfriend Kirk West, was arrested at Nashville International Airport on July 24 following a theft report filed by Jones.

Court documents reveal West allegedly stole 5,534,307 XRP tokens and $400,000 in cash from a SAFE in Jones' home. The cryptocurrency was valued at over $17 million at the time of reporting. While most of the digital assets were recovered, approximately 400,000 XRP (worth $1.2 million) remain missing.

West faces a Class A felony charge for theft exceeding $250,000, with bail set at $1 million. This incident follows West's 2026 guilty plea for bank fraud, underscoring a pattern of financial misconduct.

Is XRP a good investment?

Sophia presents a balanced view on XRP:

| Metric | Value | Implication |

|---|---|---|

| Current Price | 3.137 USDT | 5% below 20MA |

| MACD | 0.1180 | Weak bullish momentum |

| Bollinger Bands | 3.6611/3.1681/2.6750 | Neutral range |

While technicals show consolidation, the pending SEC resolution (August deadline) and whale accumulation suggest upside potential. However, traders should monitor the $3 support closely - a break below could trigger stops toward 2.6750.

Consider dollar-cost averaging with tight risk management. The $6 Wave 5 target remains plausible if XRP holds $3 and regulatory clarity emerges.